Meet Silverfin, a startup focused on accounting software. This isn’t about helping small startups handle accounting tasks themselves. Silverfin wants to build the cloud service for small and big accounting firms — Salesforce, but for accounting.

The startup just raised a Series B funding round led by Hg — Index Ventures led the previous Series A round. While terms of the deal are undisclosed, a source told me the round is worth approximately $30 million.

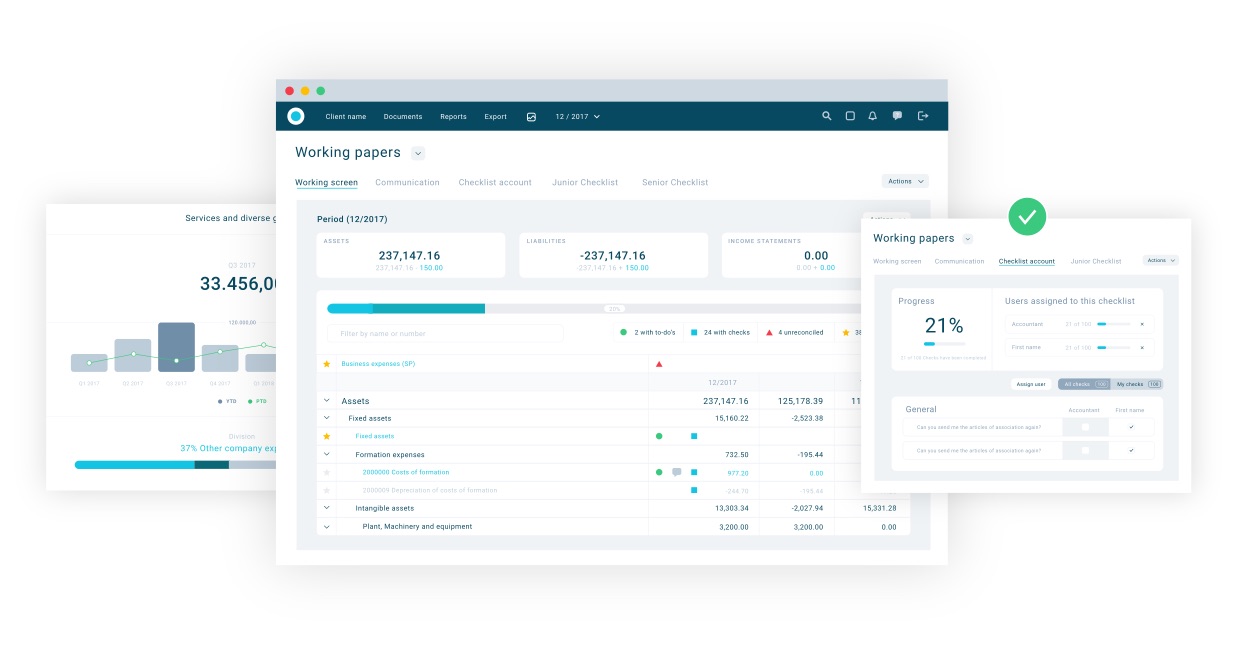

In order to improve productivity, Silverfin tries to automate the most time-consuming aspect of accounting — data collection. The company helps you connect with your clients’ accounting software directly to import their data, such as Xero, QuickBooks, Sage and SAP.

After that, Silverfin standardizes your data set and lets you add data manually so the platform can become the main data repository.

Once your data is in the system, you need to process it. Silverfin lets you configure automated workflows and templates so that anybody in the accounting firm can enrich data and check for compliance issues. Like Salesforce and other software-as-a-service products, multiple people can communicate on the service and look at all past edits and changes.

You can then visualize financial data, generate reports and statements. It opens up new possibilities for accounting firms. They can charge advisory services thanks to analytics tools and an alert system.

The startup was founded in Ghent, Belgium, but it has now expanded to London, Amsterdam and Copenhagen. Silverfin has attracted 650 customers, including big accounting firms in Europe and North America.

By targeting the most demanding customers first, Silverfin doesn’t need to replace Xero or QuickBooks altogether. It can integrate with those existing software solutions first. There’s an opportunity to go downmarket later and convince smaller companies that don’t necessarily have a big accounting team.

Continue reading...

The startup just raised a Series B funding round led by Hg — Index Ventures led the previous Series A round. While terms of the deal are undisclosed, a source told me the round is worth approximately $30 million.

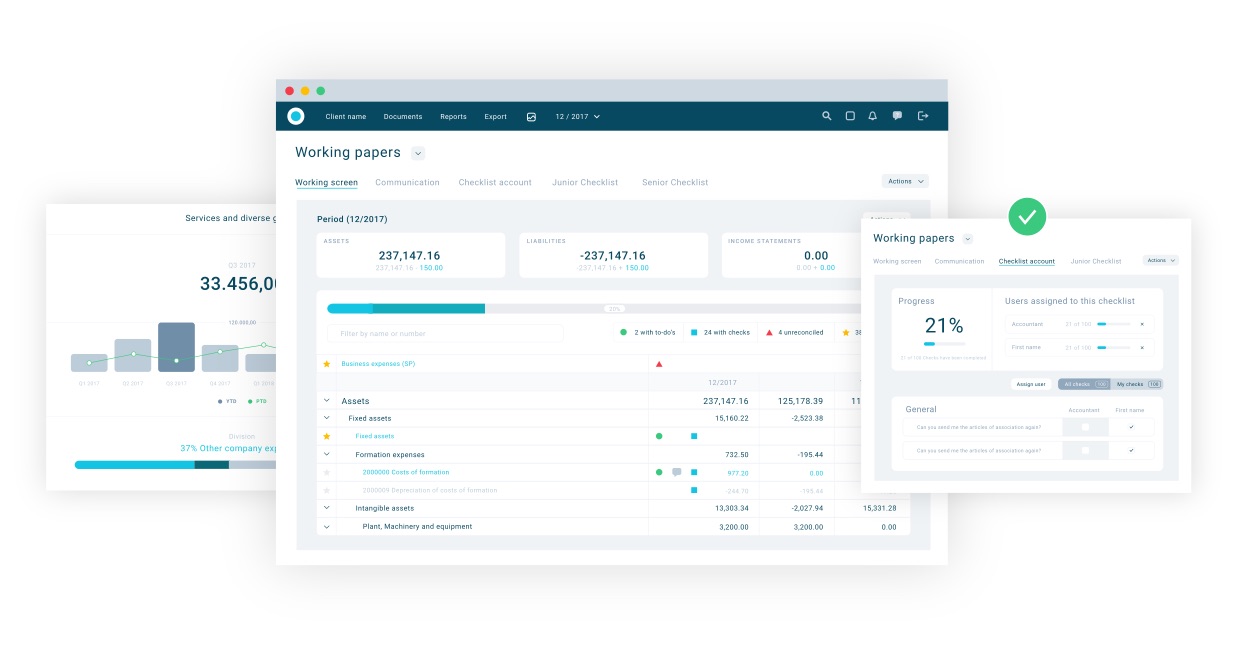

In order to improve productivity, Silverfin tries to automate the most time-consuming aspect of accounting — data collection. The company helps you connect with your clients’ accounting software directly to import their data, such as Xero, QuickBooks, Sage and SAP.

After that, Silverfin standardizes your data set and lets you add data manually so the platform can become the main data repository.

Once your data is in the system, you need to process it. Silverfin lets you configure automated workflows and templates so that anybody in the accounting firm can enrich data and check for compliance issues. Like Salesforce and other software-as-a-service products, multiple people can communicate on the service and look at all past edits and changes.

You can then visualize financial data, generate reports and statements. It opens up new possibilities for accounting firms. They can charge advisory services thanks to analytics tools and an alert system.

The startup was founded in Ghent, Belgium, but it has now expanded to London, Amsterdam and Copenhagen. Silverfin has attracted 650 customers, including big accounting firms in Europe and North America.

By targeting the most demanding customers first, Silverfin doesn’t need to replace Xero or QuickBooks altogether. It can integrate with those existing software solutions first. There’s an opportunity to go downmarket later and convince smaller companies that don’t necessarily have a big accounting team.

Continue reading...